In economic terms, that’s an inverted yield curve as short-term yields are higher than long-term yields, so the yield curve slopes downwards. Switched-on readers may have noticed earlier that 2-year bonds yield more than 10-year bonds. Sticky inflation is bad for bonds as it erodes the purchasing power of a bond’s future cash flows. There’s also the problem of high inflation. After all, you can get more yield in cash than in 2- or 10-year government bonds. Bonds have steadied so far this year, and many fund managers are proclaiming that bonds offer good value. Are bonds back, or is it just a furphy?īonds had a disastrous 2022 and investors ran for the exits. These can come with terms and conditions, so make sure you do your homework. Macquarie Bank has 12 term deposit rates of up to 5% while Judo Bank has term rates of up to 5.3%. Other banks pushing hard into the deposit space offer better. You can now get a Commonwealth Bank 12-month term deposit rate of 4.25%. It’s been a wild ride over the past 14 months! That’s thanks to the RBA lifting interest rates from a low of 0.1% in April last year to 4.1% today. Most asset classes need inflation to fall towards the RBA’s target, otherwise current pricing doesn’t make a lot of sense. Where the US goes, Australia normally follows. The inflation bulls will also point to research from Research Affiliates’ Rob Arnott that suggests once US inflation reaches above 8%, as it did last year, history shows that reverting to 3% usually takes 6 to 20 years, with a median of over 10 years. And pricing pressure will remain given significant wage increases being pushed through at the start of July, rental increases, while easing, remaining high, house prices rising off their lows, food inflation increasing at the major supermarkets and energy prices showing no sign of abating as the transition to green energy proves difficult and costly. On the supply side, the fraying of globalization could mean supply chains may not return to what they were pre-COVID. While the latest CPI report is welcome, the seasonally adjusted CPI was higher at 5.8% and the trimmed mean CPI was at 6.1%. Inflation bulls will tell the bears: hang on a moment. These factors are receding, and inflation should head back towards the RBA’s target range of 2-3%. Inflation bears will argue that the COVID induced supply chain issues reduced the supply of goods while demand spiked partly from government money printing and handouts, resulting in significant price increases and inflation issues. These expectations were buoyed from recent figures showing the consumer price index (CPI) rose 5.6% year-on-year in May, compared to economist forecasts of 6.1%.Īfter the CPI rose from close to 0% at the start of 2021 to almost 8.4% in December 2022, it’s fallen sharply over the past six months. The question is: why are assets such as bonds priced at these levels given where inflation is? Much of the answer lies with expectations that inflation will fall. That is, your money will have less purchasing power at the end of that period. If you buy a 10-year bond at par at that yield and hold onto it for the next decade, and the inflation rate remains at current levels, you’ll lose money in real terms. Yet Australian 10-year bonds for instance, offer a yield of 4.01%, well below the inflation rate of 5.60%. You’d normally like to invest in an asset class that has positive real yields so you can keep pace with, or exceed, inflation. On the face of it, this doesn’t make sense. In other words, these three asset classes are currently offering negative real yields (inflation rate minus asset class yield).

You’ll quickly notice that the yields on cash, bonds and property are closely aligned, though they remain well below the inflation rate. And I’ve included the inflation rate as a point of comparison. Here’s the latest chart for the four major asset classes: cash, bonds, property, and stocks.

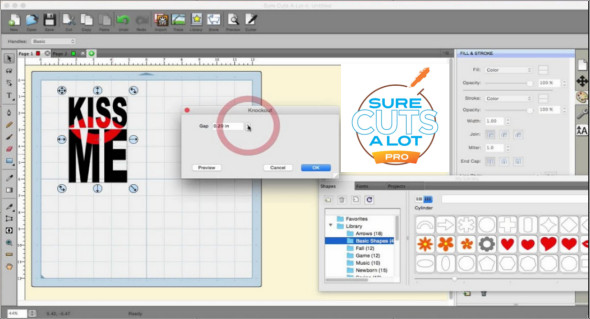

SURE CUTS A LOT 5 UPGRADE UPDATE

I give an update about every six months of the yields offered on key asset classes and how they compare.

SURE CUTS A LOT 5 UPGRADE PLUS

All rights reserved.The Weekend Edition includes a market update plus Morningstar adds links to two additional articles. Published by Houghton Mifflin Harcourt Publishing Company. Copyright © 2014 by Houghton Mifflin Harcourt Publishing Company.

The American Heritage® Student Science Dictionary, Second Edition.

0 kommentar(er)

0 kommentar(er)